Exploring the components of a homeowners insurance quote, this introduction sets the stage for a detailed discussion on what is covered and not covered. The engaging nature of the topic draws readers in with a mix of informative insights and practical advice.

Providing a comprehensive overview of the key elements, this paragraph aims to inform and educate readers about the nuances of homeowners insurance quotes.

What Does a Homeowners Insurance Quote Include?

When obtaining a homeowners insurance quote, there are several key components that are typically included to provide a comprehensive coverage plan.

Coverage Options Included in a Homeowners Insurance Quote:

- Property Coverage: This includes protection for your home and other structures on your property from covered perils such as fire, theft, and vandalism.

- Liability Coverage: This protects you in case someone is injured on your property and you are found legally responsible.

- Personal Property Coverage: This includes coverage for your personal belongings such as furniture, clothing, and electronics.

- Additional Living Expenses: In the event that your home becomes uninhabitable due to a covered loss, this coverage helps pay for temporary housing and living expenses.

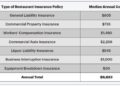

Factors Influencing the Cost of a Homeowners Insurance Quote:

- Location: The area where your home is located can impact the cost of insurance due to factors like crime rates, weather risks, and proximity to fire departments.

- Home Value and Rebuilding Costs: The value of your home and the cost to rebuild it in case of a total loss will also affect your insurance premium.

- Claims History: A history of previous insurance claims can influence the cost of your homeowners insurance quote.

- Deductibles: The amount you choose for your deductible will impact your premium, with higher deductibles usually resulting in lower premiums.

What Does a Homeowners Insurance Quote Exclude?

When getting a homeowners insurance quote, it's important to understand what is not covered in the policy. Exclusions are specific items, perils, or situations that are not included in the standard coverage and may require additional policies or endorsements for protection.Exclusions are typically in place to manage risk for insurance companies and prevent abuse of the policy.

Here are some common items that are often excluded from a homeowners insurance quote:

Common Exclusions in Homeowners Insurance Quote

- Earth movement: Damages caused by earthquakes, landslides, or sinkholes are usually not covered in standard homeowners insurance policies. Homeowners may need to purchase separate earthquake insurance for protection.

- Floods: Damage from floods is typically excluded from homeowners insurance. Homeowners in flood-prone areas may need to buy a separate flood insurance policy through the National Flood Insurance Program (NFIP) or private insurers.

- Wear and tear: Normal wear and tear, deterioration, and maintenance issues are not covered by homeowners insurance. It is the responsibility of the homeowner to maintain their property.

- Intentional damage: Any damage caused intentionally by the homeowner or their family members is not covered by insurance.

These exclusions are in place to ensure that homeowners insurance remains affordable and sustainable for both insurance companies and policyholders. It's essential for homeowners to understand these exclusions and consider purchasing additional coverage if needed.

Optional Coverages for Homeowners

- Additional coverage for high-value items: Homeowners may need to purchase additional coverage or schedule personal property endorsements for expensive items such as jewelry, art, or collectibles.

- Liability coverage: While liability coverage is included in standard homeowners insurance, homeowners may choose to increase their liability limits for extra protection.

- Sewer backup coverage: Protection against damages caused by sewer backups is often excluded from standard policies but can be added as an endorsement.

It's important to review your homeowners insurance policy carefully and discuss any specific coverage needs with your insurance provider. Exclusions can vary between insurance companies, so it's crucial to understand what is and isn't covered in your policy.

Closing Summary

In conclusion, understanding what a homeowners insurance quote includes and excludes is essential for making informed decisions about insurance coverage. By highlighting the key points discussed, this outro leaves readers with a lasting impression of the topic.

FAQ Explained

What items are typically excluded from a homeowners insurance quote?

Items such as earthquakes and floods are commonly excluded from standard homeowners insurance quotes. Separate policies or endorsements may be needed for coverage.

Why are certain items or perils excluded from coverage?

Insurance providers may exclude high-risk items or perils to manage their exposure to potential claims and losses, ensuring the financial stability of the company.

What optional coverage might homeowners need to purchase separately?

Optional coverage like identity theft protection or sewer backup coverage may need to be purchased separately to enhance the protection offered by a standard homeowners insurance policy.

How do deductibles factor into a homeowners insurance quote?

Deductibles are the amount a policyholder must pay out of pocket before their insurance coverage kicks in. Higher deductibles can lower insurance premiums, while lower deductibles lead to higher premiums.

What factors influence the cost of a homeowners insurance quote?

Factors such as the location of the home, its age, the chosen coverage limits, the presence of safety features, and the policyholder's claims history can all influence the cost of a homeowners insurance quote.