Exploring the top-rated health insurance companies in Europe opens the door to a world of vital information and insights. From understanding the significance of health insurance in Europe to delving into the innovative strategies employed by leading companies, this guide offers a deep dive into the realm of healthcare coverage.

As we navigate through the landscape of health insurance in Europe, we will unravel the key factors influencing the market, compare coverage options, and shed light on the technological advancements shaping the future of healthcare in the region.

Overview of Health Insurance in Europe

Having health insurance in Europe is crucial to ensure access to quality healthcare services without facing financial burdens. It provides individuals with the peace of mind that they will be covered in case of illness, accidents, or emergencies.

Key Factors Influencing the Health Insurance Market in Europe

- Rising healthcare costs: The increasing cost of healthcare services and treatments puts pressure on health insurance companies to adjust their premiums and coverage.

- Aging population: Europe's aging population results in higher demand for healthcare services, leading to a greater need for health insurance coverage.

- Advancements in medical technology: Technological advancements in healthcare require health insurance companies to adapt their policies to cover new treatments and procedures.

Regulatory Environment for Health Insurance Companies in Europe

- European Union regulations: Health insurance companies operating in Europe must comply with EU directives and regulations to ensure consumer protection and fair competition.

- National regulations: Each European country has its own set of regulations governing health insurance companies, including solvency requirements and consumer rights.

- Supervisory authorities: Health insurance companies are overseen by national regulatory bodies that monitor their financial stability and compliance with regulations.

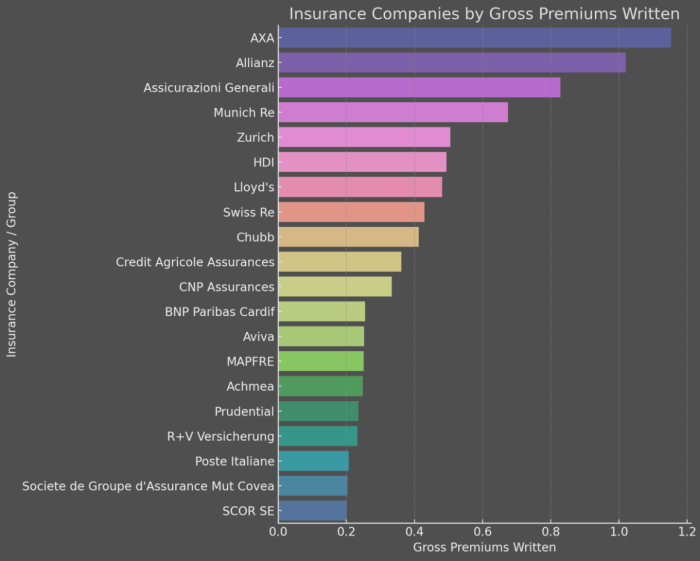

Top-rated Health Insurance Companies in Europe

When it comes to health insurance in Europe, there are several top-rated companies that stand out for their coverage options, reputation, and customer satisfaction levels.

1. Bupa

Bupa is a well-known health insurance provider in Europe, offering a wide range of coverage options including medical, dental, and travel insurance. They are known for their excellent customer service and comprehensive health plans.

2. AXA

AXA is another top-rated health insurance company in Europe, providing coverage for medical expenses, hospital stays, and emergency care. They have a strong reputation for reliability and a wide network of healthcare providers.

3. Allianz Care

Allianz Care is a leading health insurance provider in Europe, offering international health insurance plans with extensive coverage options. They are known for their flexible plans and excellent customer support.

4. Cigna

Cigna is a global health insurance company with a strong presence in Europe, offering a range of health plans for individuals, families, and businesses. They are known for their innovative healthcare solutions and personalized customer service.

5. Aviva

Aviva is a trusted health insurance provider in Europe, offering comprehensive health plans with coverage for medical treatments, surgeries, and specialist consultations. They are known for their competitive pricing and transparent policies.

Factors to Consider When Choosing a Health Insurance Company

When selecting a health insurance company in Europe, there are several key factors that individuals should consider to ensure they choose the right provider for their needs.

Financial Stability

One of the most important factors to consider when choosing a health insurance company is its financial stability. It is crucial to evaluate the financial health of the insurance company to ensure they will be able to meet their financial obligations, especially when it comes to paying out claims.

One way to assess this is by looking at the company's credit rating from independent rating agencies like Standard & Poor's or Moody's.

Network Coverage and Healthcare Provider Options

Another important factor to consider is the network coverage and healthcare provider options offered by the insurance company

This ensures that you have access to quality healthcare services when needed. Additionally, consider whether the insurance company allows you to choose your preferred healthcare providers or if they have restrictions on which providers you can see.

Policy Coverage and Benefits

When choosing a health insurance company, it is essential to carefully review the policy coverage and benefits offered. Consider what services are covered under the policy, such as hospitalization, outpatient care, prescription drugs, and preventive services. Compare the coverage options and benefits of different insurance companies to find a policy that meets your specific healthcare needs.

Customer Service and Support

Good customer service and support are crucial when dealing with a health insurance company. Consider the ease of reaching customer service representatives, the responsiveness of the company to inquiries and claims, and the overall satisfaction of existing customers. Look for reviews and ratings of the insurance company's customer service to gauge their level of support.

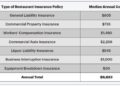

Premiums and Costs

Finally, consider the premiums and costs associated with the health insurance policy. Compare the premiums of different insurance companies and evaluate the cost-sharing requirements, such as deductibles, copayments, and coinsurance. Make sure to choose a policy that offers a good balance between affordability and coverage to ensure you get the best value for your money.

Technology and Innovation in European Health Insurance

In Europe, top-rated health insurance companies are utilizing technology to enhance their services and provide more efficient healthcare solutions to their customers.

Telemedicine Services

Telemedicine services have become increasingly popular among health insurance companies in Europe. Through teleconsultation and remote monitoring, patients can receive medical advice and treatment from healthcare professionals without the need for in-person visits. This not only improves access to healthcare services but also reduces healthcare costs for both the insurance companies and their customers.

Digital Health Platforms

Many top-rated health insurance companies in Europe offer digital health platforms that allow customers to access their health information, schedule appointments, refill prescriptions, and track their health progress online. These platforms not only provide convenience to the customers but also enable insurance companies to gather valuable data for personalized healthcare solutions.

Health Apps and Wearable Devices

Health insurance companies are partnering with health app developers and wearable device manufacturers to promote healthy lifestyles among their customers. By incentivizing the use of health apps and wearable devices that track physical activity, sleep patterns, and nutrition, insurance companies can encourage preventive healthcare practices and reduce the risk of chronic diseases.

Data Analytics and AI

Data analytics and artificial intelligence are being utilized by health insurance companies in Europe to analyze large amounts of healthcare data and identify trends for better decision-making. AI-powered tools can help insurance companies predict healthcare outcomes, personalize treatment plans, and detect fraudulent claims, ultimately improving the quality of healthcare services and reducing costs.

Virtual Reality and Augmented Reality

Some innovative health insurance companies in Europe are exploring the use of virtual reality and augmented reality technologies to enhance patient care and rehabilitation. By creating virtual environments for therapy sessions or using AR overlays for surgical procedures, insurance companies can improve patient outcomes and provide a more immersive healthcare experience.

Blockchain Technology

Blockchain technology is also making its way into the healthcare industry in Europe, offering secure and transparent solutions for data management, patient records, and insurance claims. By implementing blockchain-based systems, health insurance companies can ensure the privacy and integrity of sensitive healthcare information while streamlining administrative processes and reducing fraud.

Epilogue

In conclusion, the realm of top-rated health insurance companies in Europe is a dynamic and evolving sector that prioritizes customer satisfaction, financial stability, and technological innovation. By staying informed and considering the factors discussed in this guide, individuals can make well-informed decisions when selecting a health insurance provider in Europe.

FAQ Corner

What are the key factors individuals should consider when selecting a health insurance company in Europe?

Individuals should consider factors such as coverage options, reputation, customer satisfaction, network coverage, and healthcare provider options.

How can one evaluate the financial stability of health insurance companies?

One can evaluate the financial stability of health insurance companies by reviewing their financial statements, credit ratings, and industry assessments.

What role does technology play in shaping the future of health insurance in Europe?

Technology is instrumental in enhancing services, offering innovative programs, and improving overall efficiency in the healthcare sector.