Small Business Insurance Coverage Explained in Simple Terms sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

In the following paragraphs, we will delve into the importance of small business insurance, the various types of coverage available, factors influencing insurance costs, the claims process, and coverage limitations.

Importance of Small Business Insurance

Small business insurance plays a crucial role in safeguarding a business from unexpected risks and liabilities. Without adequate insurance coverage, a small business may face financial ruin due to unforeseen events.

Protection Against Lawsuits

- Small business insurance can protect your business from costly lawsuits. For example, if a customer slips and falls in your store, general liability insurance can cover the medical expenses and legal fees.

- Without insurance, your business may have to pay out of pocket for legal expenses, settlements, or judgments, which can be financially devastating.

Property Damage Coverage

- In the event of a fire, theft, or natural disaster, property insurance can help cover the cost of repairs or replacement of damaged property, such as equipment, inventory, or the physical location of your business.

- Operating without property insurance puts your business at risk of losing valuable assets and disrupting operations due to unexpected events.

Worker's Compensation Benefits

- Having worker's compensation insurance ensures that your employees are protected in case of work-related injuries or illnesses. This coverage can help with medical expenses and lost wages for injured employees.

- Without worker's compensation insurance, your business may be liable for expensive medical bills and legal fees if an employee gets injured on the job.

Business Continuity

- Insurance coverage can provide financial support to help your business recover and continue operations after a covered loss. This can include income replacement, temporary relocation expenses, and other costs associated with resuming business activities.

- Operating without insurance jeopardizes the continuity of your business in the face of unexpected events, potentially leading to closure or bankruptcy.

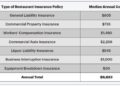

Types of Small Business Insurance Coverage

When it comes to protecting your small business, having the right insurance coverage in place is crucial. Here are some common types of insurance coverage available to small businesses:

General Liability Insurance

General liability insurance is essential for small businesses as it provides coverage for third-party bodily injury, property damage, and advertising injury claims. This type of insurance can protect your business from lawsuits and financial losses resulting from accidents or negligence.

Property Insurance

Property insurance is designed to protect your business's physical assets, such as buildings, equipment, inventory, and furniture, from risks like fire, theft, vandalism, and natural disasters. Having property insurance can help you recover quickly in the event of a covered loss.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is crucial for service-based businesses. It provides coverage for claims of negligence, errors, or omissions related to professional services provided by your business. This type of insurance can protect you from legal costs and damages if a client alleges that your work caused them financial harm.

Specialty Insurance Options

In addition to general liability, property, and professional liability insurance, there are specialty insurance options tailored to specific industries or risks. For example, cyber liability insurance protects businesses from data breaches and cyber-attacks, while commercial auto insurance covers vehicles used for business purposes.

It's important to assess your business's unique risks and consider specialized insurance coverage to ensure comprehensive protection.

Factors Influencing Small Business Insurance Costs

When it comes to determining the cost of insurance for small businesses, several key factors come into play. These factors can significantly impact the premiums a business will pay for insurance coverage. Understanding these factors is crucial for small business owners to effectively manage their insurance costs.

Business Size

The size of a business is a major factor that influences insurance costs. Larger businesses with more employees, higher revenues, and greater assets typically face higher insurance premiums. This is because larger businesses generally have more exposure to risk, which insurance companies take into account when calculating premiums

Location

The location of a business can also impact insurance costs. Businesses located in areas prone to natural disasters, high crime rates, or other risks may face higher insurance premiums. On the other hand, businesses in safer locations with lower risk factors may enjoy lower insurance costs.

Industry

The industry in which a business operates plays a significant role in determining insurance costs. Industries with higher inherent risks, such as construction or healthcare, typically have higher insurance premiums. Businesses in low-risk industries, such as consulting or technology, may have lower insurance costs.

Coverage Limits

The coverage limits chosen by a business can also impact insurance costs. Higher coverage limits provide greater protection but also result in higher premiums. Businesses need to carefully assess their coverage needs and strike a balance between adequate protection and affordability.

Strategies for Managing Insurance Costs

- Shop around and compare quotes from different insurance providers to find the best rates.

- Consider bundling different types of insurance policies with the same provider for potential discounts.

- Implement risk management practices to reduce the likelihood of insurance claims and demonstrate to insurers that your business is a lower risk.

- Regularly review and update your insurance coverage to ensure it aligns with your changing business needs and risks.

Claims Process and Coverage Limitations

Insurance claims can be a daunting process for small business owners, but understanding the typical steps involved and being aware of coverage limitations is crucial to ensure a smooth experience when filing a claim.

Common Limitations and Exclusions

- One common limitation to be aware of is the coinsurance clause, which requires the insured to carry a certain percentage of the total value of the property insured. Failure to meet this requirement could result in reduced claim payments.

- Exclusions in insurance policies may include intentional acts, wear and tear, and certain natural disasters. It's important for small business owners to carefully review their policy to understand what is not covered.

- Business interruption coverage typically has limitations on the length of time for which benefits are payable. Small business owners should be aware of these limits when selecting coverage.

Tips for Maximizing Coverage and Streamlining Claims

- Regularly review and update your insurance policy to ensure it reflects any changes in your business operations or assets. This can help avoid coverage gaps.

- Documenting any incidents or losses with photos, videos, and written descriptions can streamline the claims process and provide evidence to support your claim.

- Work closely with your insurance agent or broker to understand your policy and ask questions about coverage limitations or exclusions. They can help you navigate the claims process more effectively.

Conclusion

In conclusion, Small Business Insurance Coverage Explained in Simple Terms sheds light on a complex subject, simplifying it for easy understanding while emphasizing the significance of insurance for small businesses.

Essential Questionnaire

Why is small business insurance important?

Small business insurance is crucial for protecting a business from financial losses due to unexpected events like property damage, liability claims, or lawsuits.

What are the common types of small business insurance coverage?

Common types include general liability, property, and professional liability insurance.

How do factors like business size and location influence insurance costs?

Factors like business size and location can affect insurance premiums due to varying risks associated with different industries and geographic areas.

What are some common limitations in insurance policies for small businesses?

Common limitations can include exclusions for certain risks or coverage limits that may not fully protect against all potential losses.