Embark on a journey through the world of restaurant insurance quotes, exploring the essential aspects to consider before opening your own establishment. This informative guide delves into the intricacies of insurance coverage, factors influencing quotes, and tips for choosing the right policy tailored to your restaurant's needs.

Understanding Restaurant Insurance

Restaurant insurance is essential for protecting your business from unexpected events. It provides coverage for various risks that restaurant owners face on a daily basis.

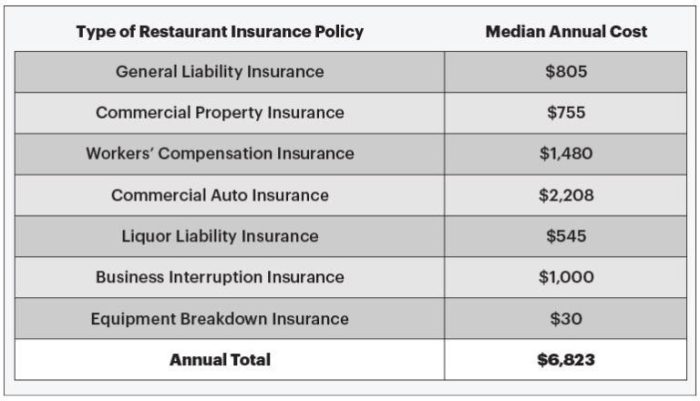

Types of Insurance Coverage

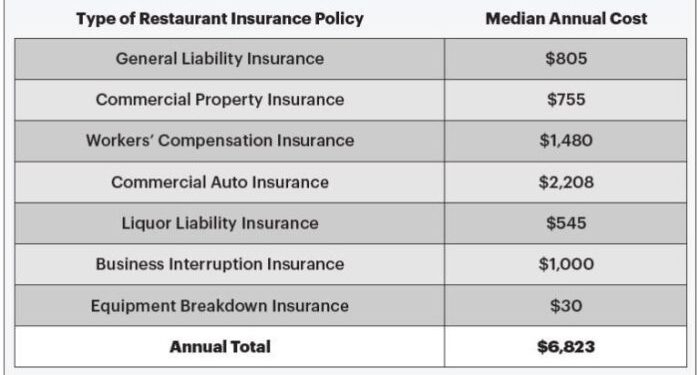

- General Liability Insurance: Covers claims of bodily injury, property damage, and personal injury.

- Property Insurance: Protects your restaurant building, equipment, and inventory from damages due to fire, theft, or other perils.

- Workers' Compensation Insurance: Provides benefits to employees who are injured or become ill while on the job.

- Business Interruption Insurance: Helps cover lost income and expenses if your restaurant has to close temporarily due to a covered event.

Importance of Restaurant Insurance

Having adequate insurance for your restaurant is crucial as it can protect you from financial losses that could otherwise put your business at risk. Without insurance, you could be personally liable for damages, legal fees, and medical expenses.

Common Insurance Claims in the Restaurant Industry

- Slip and fall accidents: Customers slipping on a wet floor or tripping over obstacles.

- Foodborne illness: Claims related to food poisoning or contamination.

- Fire damage: Kitchen fires or electrical malfunctions leading to property damage.

Factors Influencing Insurance Quotes

Insurance quotes for restaurants are influenced by various factors that determine the cost of coverage. Understanding these key factors is essential for restaurant owners looking to secure the right insurance policy for their business.

Location of the Restaurant

The location of a restaurant plays a significant role in determining insurance quotes. Restaurants located in high-crime areas or regions prone to natural disasters may face higher insurance premiums due to the increased risk of property damage or theft. On the other hand, restaurants situated in safer neighborhoods with lower crime rates may enjoy more affordable insurance rates.

Restaurant's Size and Revenue

The size and revenue of a restaurant also impact insurance premiums. Larger restaurants with more square footage and higher revenue streams may require higher coverage limits, resulting in higher premiums. Additionally, restaurants with a history of high revenue and profitability may be seen as less risky by insurance providers, potentially leading to lower insurance costs.

Choosing the Right Insurance Coverage

When it comes to choosing the right insurance coverage for your restaurant, there are several key considerations to keep in mind. From general liability insurance to workers' compensation coverage, each type of insurance plays a crucial role in protecting your business and employees.

Let's delve into the details to help you make an informed decision.

General Liability Insurance vs. Property Insurance

General liability insurance and property insurance are both essential for restaurants, but they serve different purposes. General liability insurance protects your business from third-party claims of bodily injury, property damage, or advertising injury. On the other hand, property insurance covers damages to your restaurant's physical assets, such as the building, equipment, and inventory.

It's important to have both types of coverage to safeguard your restaurant against various risks

Significance of Workers' Compensation Insurance

Workers' compensation insurance is crucial for restaurant owners as it provides coverage for employees who are injured or fall ill while on the job. This type of insurance helps cover medical expenses, lost wages, and rehabilitation costs for employees, ensuring that they are taken care of in case of an unfortunate incident.

By having workers' compensation insurance, you demonstrate your commitment to the well-being of your staff and comply with legal requirements.

Tips for Selecting Adequate Coverage

When selecting insurance coverage for your restaurant, consider the specific needs of your business. Take into account factors such as the size of your establishment, the number of employees, the type of cuisine you serve, and the location of your restaurant.

Work with an experienced insurance agent who understands the restaurant industry to tailor a policy that meets your unique requirements. Remember to review and update your coverage regularly to adapt to changes in your business operations and external factors.

Insurance Quotes Process

When opening a new restaurant, obtaining insurance quotes is an essential step to protect your business from potential risks. Insurance providers assess various factors to determine the level of risk associated with insuring your restaurant, which ultimately influences the quotes you receive.

Here's a breakdown of the steps involved in obtaining insurance quotes for a new restaurant and the information required by insurance companies during the quoting process.

Assessment of Risks

Insurance providers assess several key factors when providing quotes for restaurant insurance. These factors include the location of your restaurant, the type of cuisine you serve, the size of your establishment, the number of employees, and your previous insurance claims history.

By evaluating these aspects, insurance providers can determine the level of risk associated with insuring your restaurant and adjust the quotes accordingly.

- Location: Insurance companies consider the location of your restaurant to assess the risk of potential hazards such as crime rates, natural disasters, and proximity to high-traffic areas.

- Type of Cuisine: The type of cuisine you serve can impact the risk level, as certain cuisines may involve higher risks of fire or food-related incidents.

- Size and Capacity: The size of your restaurant and its seating capacity can influence the potential risks and liabilities, affecting the insurance quotes you receive.

- Employee Count: The number of employees you have can affect the level of workers' compensation coverage required, which in turn impacts the overall insurance quotes.

- Claims History: Your past insurance claims history is also a crucial factor, as a higher frequency of claims may result in higher insurance premiums.

Information Required

During the quoting process, insurance companies typically require specific information to provide accurate quotes for your restaurant insurance coverage. This information may include details about your restaurant's operations, the value of your property and equipment, the coverage limits you require, and any additional endorsements or specialized coverage needed to protect your business adequately.

- Restaurant Operations: You will need to provide details about your restaurant's operations, including the services you offer, hours of operation, and any unique risks associated with your business.

- Property Value: Insurance companies will require information about the value of your property, equipment, and inventory to determine the appropriate coverage limits for your restaurant.

- Coverage Limits: You should specify the coverage limits you require for different types of insurance, such as general liability, property insurance, workers' compensation, and business interruption coverage.

- Specialized Coverage: Depending on your restaurant's specific needs, you may need additional endorsements or specialized coverage options, such as liquor liability insurance or food spoilage coverage.

Closure

In conclusion, understanding the nuances of restaurant insurance quotes is crucial for safeguarding your business and ensuring financial security. By grasping the key elements discussed in this guide, you can navigate the complexities of insurance coverage with confidence as you embark on your restaurant venture.

Commonly Asked Questions

What are the key factors that influence insurance quotes for restaurants?

The location of the restaurant, its size, revenue, and the coverage options chosen all play a significant role in determining insurance quotes.

How do insurance providers assess risks when providing quotes?

Insurance providers evaluate various factors such as the restaurant's history of claims, safety measures in place, and the specific risks associated with the business.

What is the significance of workers' compensation insurance for restaurant employees?

Workers' compensation insurance is crucial for covering medical expenses and lost wages for employees who are injured on the job.