Exploring the best countries for property investment in Asia and Europe unveils a world of opportunities and potential growth. From the bustling markets of Asia to the stable economies of Europe, this guide delves into the key factors that shape investment trends across continents.

As we navigate through the top countries in each region, you'll gain insights into the economic landscapes, legal frameworks, and growth potentials that make them prime destinations for property investors.

Overview of Property Investment in Asia and Europe

Property investment in both Asia and Europe has been a popular choice for investors looking to diversify their portfolios and generate passive income. The real estate markets in these regions offer a range of opportunities for both short-term gains and long-term growth.

When comparing property investment trends between Asia and Europe, some similarities can be observed. Both regions attract foreign investors due to stable economic conditions, growing urbanization, and potential for high returns on investment. Additionally, real estate in major cities of Asia and Europe has shown resilience during economic downturns, making it a relatively safe investment option.

Key Factors for Attractive Property Investment Countries

- Strong Economic Growth: Countries with robust economic growth are more likely to attract property investors as they offer better rental yields and potential for capital appreciation.

- Political Stability: Political stability is crucial for property investors as it ensures the protection of their investments and reduces the risk of sudden policy changes affecting the real estate market.

- Infrastructure Development: Countries investing in infrastructure development, such as transportation networks and smart cities, tend to attract more property investors due to increased demand for real estate in these areas.

- Foreign Investor-Friendly Policies: Countries with favorable policies for foreign investors, such as ease of property acquisition and residency permits, are more likely to see an influx of international capital into their real estate markets.

- Tourism and Hospitality Sector: Countries with a thriving tourism and hospitality sector often present attractive opportunities for property investment, especially in popular tourist destinations where rental income can be high.

Best Countries for Property Investment in Asia

Investing in property in Asia can be a lucrative opportunity due to the region's economic growth and development. Several countries stand out as top choices for property investment, offering stability and growth potential for investors.

1. Singapore

Singapore is known for its strong economy, political stability, and transparent legal system, making it an attractive destination for property investment. The real estate market in Singapore has shown resilience and steady growth over the years, making it a popular choice for investors looking for a safe and reliable investment option.

2. Japan

Japan is another top country for property investment in Asia, known for its advanced infrastructure, technological innovation, and stable political environment. The real estate market in Japan offers diverse opportunities, from residential properties in major cities like Tokyo to commercial properties in business districts.

3. Hong Kong

Despite its small size, Hong Kong is a major player in the global real estate market, attracting investors with its strategic location, vibrant business environment, and high rental yields. The property market in Hong Kong is competitive but offers high returns for savvy investors willing to navigate the market.

4. South Korea

South Korea's booming economy, technological advancements, and strong urban development make it an attractive destination for property investment. The real estate market in South Korea is dynamic, with opportunities in residential, commercial, and industrial properties across the country.

5. Malaysia

Malaysia offers a mix of affordability, growth potential, and diverse property options for investors. With a stable political climate and government incentives for foreign investors, Malaysia's real estate market is poised for growth, especially in key cities like Kuala Lumpur and Penang.

Best Countries for Property Investment in Europe

When it comes to property investment in Europe, there are several countries that stand out for offering favorable conditions and opportunities. These countries have robust legal frameworks, attractive rental yields, and promising capital appreciation potential.

Top Countries for Property Investment in Europe

Europe boasts a diverse real estate market, but some countries are particularly popular among investors due to their stable economies and strong property laws. Here are some of the top countries for property investment in Europe:

- United Kingdom: The UK, particularly cities like London and Manchester, has traditionally been a hotspot for property investment, offering high rental yields and strong capital growth.

- Germany: Known for its stable economy and rental market, Germany is a favorite among investors looking for long-term returns and low vacancy rates.

- France: With its rich cultural heritage and high demand for rental properties, France is an attractive destination for property investors seeking both capital appreciation and steady rental income.

- Spain: The Spanish property market has rebounded in recent years, offering investors opportunities for both short-term gains and long-term growth, especially in cities like Barcelona and Madrid.

Legal Framework and Regulations

Each of these countries has its own set of regulations governing property ownership and investment. It's important for investors to familiarize themselves with the legal framework in order to make informed decisions and ensure compliance with local laws.

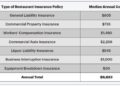

Financial Aspects of Property Investment

When comparing the financial aspects of property investment in Europe, factors such as rental yields, capital appreciation potential, and financing options play a crucial role. Investors should conduct thorough research and analysis to determine which country offers the best combination of returns and growth potential for their investment goals.

Factors to Consider Before Investing in Property

Investing in property in Asia or Europe can be a lucrative venture, but it is crucial for investors to consider several factors before making a decision. From location to market trends, understanding these elements can greatly impact the success of a property investment.

Additionally, cultural and economic factors play a significant role in determining the viability of an investment in a particular country.

Location

- Accessibility to amenities, transportation, and infrastructure

- Proximity to schools, hospitals, and commercial areas

- Potential for future development and growth in the area

- Local regulations and zoning laws

Market Trends

- Supply and demand dynamics in the local property market

- Historical and projected property price trends

- Interest rates and mortgage availability

- Political stability and government policies affecting the real estate sector

Property Type

- Residential, commercial, or mixed-use properties

- Rental yield potential and capital appreciation prospects

- Maintenance and management requirements

- Regulatory considerations for different property types

Potential Risks

- Market volatility and economic uncertainties

- Legal issues and property ownership rights

- Foreign exchange risks and currency fluctuations

- Environmental factors and natural disasters

Cultural and Economic Factors

- Local customs, traditions, and lifestyle preferences

- Population growth and demographic trends

- Economic indicators such as GDP growth and unemployment rates

- Taxation policies and incentives for real estate investors

Final Review

In conclusion, the allure of property investment in Asia and Europe lies in the diverse opportunities and promising returns that await discerning investors. By understanding the nuances of each market and considering essential factors, investors can make informed decisions to maximize their investment potential.

Frequently Asked Questions

What are the key factors that make certain countries in Asia and Europe attractive for property investment?

These factors typically include economic stability, political climate, growth potential, legal frameworks, and market trends.

How does the legal framework differ in property ownership and investment between Asia and Europe?

In Asia, regulations may vary significantly between countries, while Europe generally has more standardized legal frameworks that offer investor-friendly conditions.

What financial aspects should investors consider before investing in property in Europe?

Investors should analyze rental yields, capital appreciation rates, taxation policies, and overall market performance to make informed decisions.

How can cultural and economic factors influence the success of a property investment in a particular country?

Cultural preferences, economic stability, and local market dynamics play a crucial role in determining the success and sustainability of a property investment in any country.