A Comprehensive Guide to Commercial Auto Policy for Small Businesses provides a thorough examination of the intricacies surrounding this essential aspect for small enterprises. From understanding the differences between personal and commercial coverage to exploring various coverage options, this guide is designed to equip business owners with the knowledge needed to make informed decisions.

Delve into the following sections to gain a deeper insight into the world of commercial auto policies and how they can benefit your business.

Overview of Commercial Auto Policy for Small Businesses

Having a commercial auto policy is essential for small businesses that use vehicles for work purposes. It provides protection in case of accidents, damages, or liabilities that may arise while conducting business activities.

Key Differences Between Personal and Commercial Auto Insurance

Commercial auto insurance differs from personal auto insurance in several key ways:

- Commercial auto insurance covers vehicles used for business purposes, while personal auto insurance is for personal use vehicles.

- Commercial policies typically have higher liability limits to protect businesses from potential lawsuits.

- Commercial policies may cover multiple drivers and vehicles under a single policy, which is not common in personal auto insurance.

Types of Vehicles Covered Under a Commercial Auto Policy

A commercial auto policy typically covers a range of vehicles used for business purposes, including:

- Company cars used for employee transportation.

- Delivery vans or trucks used for transporting goods.

- Construction vehicles used for work at job sites.

- Taxis or other transportation vehicles used for passenger services.

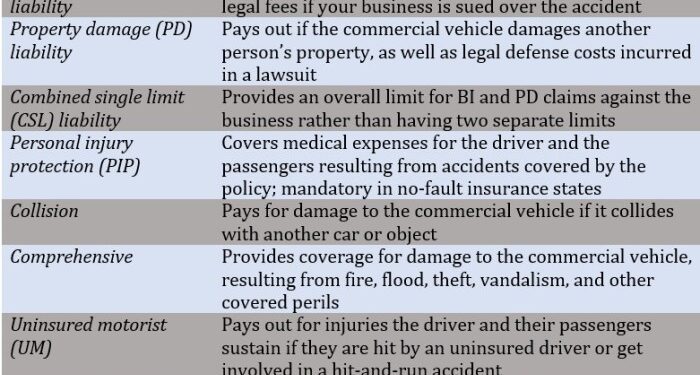

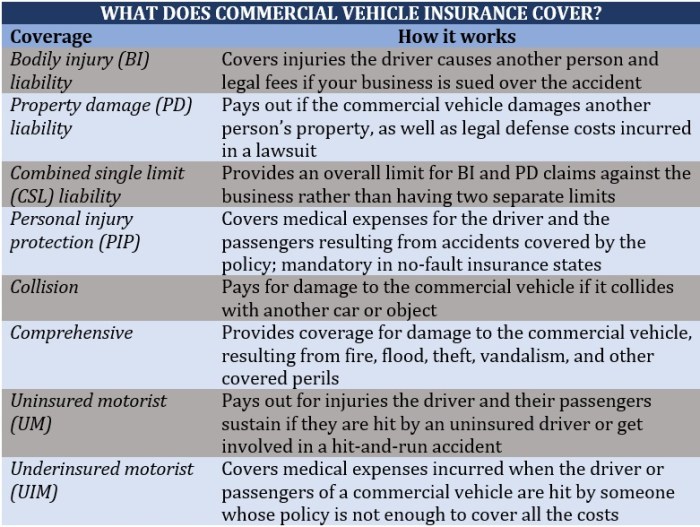

Coverage Options in Commercial Auto Policies

When it comes to commercial auto policies, there are several coverage options available for small businesses to consider. These options are designed to provide protection in various situations that may arise while using company vehicles.

Liability Coverage

One of the most important types of coverage in a commercial auto policy is liability coverage. This coverage helps protect your business financially in case you or your employees are at fault in an accident that causes injury or property damage to others.

Without liability coverage, your business could face significant financial losses from legal claims and medical expenses.

- Liability coverage typically includes bodily injury liability and property damage liability.

- Bodily injury liability helps cover medical expenses and lost wages for individuals injured in an accident.

- Property damage liability helps cover the cost of repairing or replacing damaged property.

Additional Coverage Options

In addition to liability coverage, small businesses may also consider adding the following coverage options to their commercial auto policy:

- Collision Coverage:Helps pay for repairs to your vehicle if it is damaged in a collision with another vehicle or object.

- Comprehensive Coverage:Covers damage to your vehicle from non-collision incidents, such as theft, vandalism, or natural disasters.

- Medical Payments Coverage:Helps cover medical expenses for you and your passengers if injured in an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage:Protects you if you are in an accident with a driver who has insufficient or no insurance.

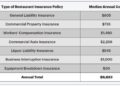

Factors Affecting Commercial Auto Insurance Premiums

Commercial auto insurance premiums are influenced by various factors that small businesses need to consider when selecting coverage. Understanding these factors can help businesses make informed decisions to manage insurance costs effectively.

Driving History and Type of Business

The driving history of employees operating commercial vehicles plays a significant role in determining insurance premiums. A history of accidents or traffic violations can lead to higher premiums due to the increased risk associated with such drivers

For example, businesses involved in high-risk industries may face higher insurance costs.

Number of Vehicles and Coverage Limits

The number of vehicles a business needs to insure and the coverage limits selected also affect insurance premiums. Insuring multiple vehicles can increase premiums, especially if they are used extensively for business purposes. Moreover, higher coverage limits provide greater protection but come with higher premiums.

Businesses should evaluate their needs carefully to strike a balance between coverage and cost.

Strategies to Lower Insurance Premiums

- Implement Safe Driving Practices: Encourage employees to follow safe driving practices to minimize accidents and maintain a clean driving record.

- Choose Vehicles Wisely: Select vehicles with safety features and lower repair costs to potentially reduce insurance premiums.

- Bundle Policies: Consider bundling commercial auto insurance with other business insurance policies to qualify for discounts.

- Review Coverage Regularly: Periodically review your coverage needs and adjust the policy to reflect changes in your business operations.

Filing a Claim under a Commercial Auto Policy

When it comes to filing a claim under a commercial auto policy, there are specific steps that small business owners need to follow to ensure a smooth process. It is essential to gather the right information and avoid common pitfalls that could delay or complicate the claims process.

Steps for Filing a Claim

- Contact your insurance provider as soon as possible after the incident to report the claim.

- Provide all relevant details about the accident, including the date, time, location, and any other parties involved.

- Document the damage with photos and gather witness information if possible.

- Fill out any necessary claim forms accurately and completely.

- Cooperate with the insurance company's investigation and provide any additional information they may request.

Information to Gather for Filing a Claim

- Policy information, including your policy number and coverage details.

- Details of the accident, such as the police report, photos of the damage, and witness statements.

- Information about any injuries sustained in the accident, including medical records and bills.

- Contact information for all parties involved, including their insurance details.

- Any other relevant documentation, such as repair estimates or rental car receipts.

Common Pitfalls to Avoid

- Delaying the claim reporting process, which could result in a denial of coverage.

- Providing incomplete or inaccurate information on the claim forms.

- Not cooperating with the insurance company's investigation or refusing to provide requested information.

- Settling for a lower claim amount than you are entitled to without seeking proper compensation.

- Failing to review your policy to understand your coverage and rights in the claims process.

Last Word

In conclusion, A Comprehensive Guide to Commercial Auto Policy for Small Businesses sheds light on the complexities of this insurance realm, empowering small business owners to navigate the intricacies with confidence. By understanding the nuances of coverage options, factors affecting premiums, and the claims process, businesses can safeguard their operations and assets effectively.

Common Queries

What types of vehicles are covered under a commercial auto policy?

Commercial auto policies typically cover a range of vehicles used for business purposes, including cars, trucks, vans, and specialty vehicles. It's important to review your policy to ensure all necessary vehicles are included.

How can small businesses lower their insurance premiums for commercial auto policies?

Small businesses can potentially reduce insurance premiums by maintaining a clean driving record, bundling policies, choosing higher deductibles, and implementing safety measures for their vehicles and drivers. Consulting with an insurance agent can also provide personalized recommendations.

What information should small business owners gather when filing a claim under a commercial auto policy?

When filing a claim, small business owners should gather details such as the date and location of the incident, the names and contact information of parties involved, police reports (if applicable), and any relevant photos or documentation. This information can help expedite the claims process.