Why Geico Commercial Auto Insurance Is a Smart Business Choice sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

The following paragraphs will delve into the specifics of why Geico's commercial auto insurance stands out as a top-notch option for businesses.

Importance of Commercial Auto Insurance

Commercial auto insurance is a crucial investment for businesses of all sizes, providing protection and financial security in the event of accidents or unforeseen circumstances involving company vehicles.

Significance of Having Commercial Auto Insurance

- Commercial auto insurance helps cover the costs of vehicle repairs or replacements, medical expenses, and legal fees resulting from accidents involving business vehicles.

- Without proper insurance coverage, businesses risk facing significant financial losses that could potentially lead to bankruptcy or closure.

- Having commercial auto insurance demonstrates a commitment to responsible business practices and ensures compliance with legal requirements in many jurisdictions.

Risks Faced Without Proper Commercial Auto Insurance Coverage

- Businesses without adequate commercial auto insurance may be held liable for damages caused by their vehicles in accidents, leading to costly legal battles and settlements.

- In the absence of insurance protection, businesses may struggle to cover the expenses related to vehicle repairs, medical bills, and property damage resulting from accidents.

Potential Liabilities Without Adequate Insurance Protection

- Without proper coverage, businesses may be responsible for compensating injured parties for medical expenses, lost wages, and pain and suffering resulting from accidents involving their vehicles.

- Business owners could face personal financial liability if their company vehicles are involved in accidents and are not adequately insured, putting their assets at risk.

GEICO Commercial Auto Insurance Features

When it comes to commercial auto insurance, GEICO offers a range of features that make it a smart choice for businesses of all sizes. Let's take a closer look at some of the specific features that GEICO provides:

Coverage Options

- Liability Coverage: GEICO offers liability coverage to protect your business in case of accidents where you are at fault.

- Collision Coverage: This feature helps cover the cost of damages to your vehicle in the event of a collision.

- Comprehensive Coverage: GEICO's comprehensive coverage takes care of damages not caused by collisions, such as theft, vandalism, or natural disasters.

- Medical Payments Coverage: This option provides coverage for medical expenses resulting from accidents, regardless of fault.

Comparison with Other Providers

When comparing GEICO's coverage options with other insurance providers in the market, GEICO stands out for its competitive rates and comprehensive coverage. Customers often praise GEICO for its excellent customer service and claims handling process, making it a preferred choice for many businesses.

Customer Testimonials

"GEICO's commercial auto insurance has been a lifesaver for my business. Their coverage options are affordable and comprehensive, and their customer service is top-notch."

John D., Small Business Owner

"I switched to GEICO for my commercial auto insurance, and I couldn't be happier. Their claims process is quick and hassle-free, and their rates are unbeatable."

Sarah M., Restaurant Owner

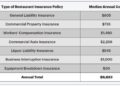

Cost-Effectiveness of GEICO Commercial Auto Insurance

When it comes to choosing commercial auto insurance for your business, cost-effectiveness is a key factor to consider. GEICO offers competitive pricing that can provide significant savings for businesses of all sizes.GEICO's pricing structure is designed to be transparent and affordable, with options for businesses to customize their coverage based on their specific needs.

By offering a range of coverage options at competitive rates, GEICO ensures that businesses can find a policy that fits within their budget while still providing the necessary protection.

Pricing Structures and Potential Savings

- GEICO offers competitive rates for commercial auto insurance, allowing businesses to find coverage that fits their budget.

- Businesses can potentially save money by bundling multiple policies together with GEICO, such as combining commercial auto insurance with general liability insurance.

- GEICO also offers discounts for businesses with a clean driving record or for those who have implemented safety measures for their fleet vehicles.

Alignment of Pricing with Value

- While GEICO provides cost-effective options for commercial auto insurance, the value it offers to businesses is not compromised.

- Businesses can benefit from GEICO's excellent customer service, easy claims process, and additional features such as roadside assistance and rental reimbursement.

- By aligning its pricing with the value it provides, GEICO ensures that businesses can have peace of mind knowing they are getting a quality insurance policy at a competitive price.

Benefits of Choosing GEICO

When it comes to selecting commercial auto insurance for your business, GEICO offers a range of unique benefits that make it a smart choice for business owners. From tailored services to additional perks, GEICO stands out in the industry for several reasons.

Catering to Business Owners' Needs

GEICO understands the specific requirements of business owners when it comes to commercial auto insurance. With customizable policies and flexible coverage options, GEICO ensures that your business is protected in the best possible way.

Additional Perks and Advantages

In addition to comprehensive coverage, GEICO provides perks such as 24/7 customer service support, easy claims processing, and access to a network of trusted repair shops. These additional advantages make GEICO a convenient and reliable choice for business owners looking for commercial auto insurance.

Final Review

In conclusion, Geico Commercial Auto Insurance emerges as a smart and reliable choice for businesses, providing comprehensive coverage and excellent value.

Popular Questions

Is Geico Commercial Auto Insurance suitable for small businesses?

Yes, Geico offers tailored solutions suitable for small businesses, providing cost-effective coverage options.

Does Geico Commercial Auto Insurance cover rental vehicles?

Yes, Geico's commercial auto insurance can extend coverage to rental vehicles in certain situations.

Are there any discounts available for multiple vehicles insured with Geico?

Geico offers discounts for insuring multiple vehicles, making it a cost-effective choice for businesses with a fleet.