Delve into the world of homeowners insurance quotes in 2025 with this detailed guide that unravels the complexities and nuances of finding the best deals. From researching to customizing policies, this article covers it all.

As we navigate through the intricacies of homeowners insurance quotes in 2025, you'll discover insider tips and expert advice to secure the most favorable quotes for your home.

Researching Homeowners Insurance Quotes

When looking for the best homeowners insurance quote in 2025, it is crucial to conduct thorough research to ensure you are getting the right coverage at the best price. Here are some tips on where to research for homeowners insurance quotes, the importance of comparing quotes from multiple providers, and how to leverage online tools and resources efficiently.

Where to Research for Homeowners Insurance Quotes

- Start by checking the websites of major insurance companies to get an idea of their offerings and pricing.

- Use comparison websites that allow you to input your information once and receive quotes from multiple providers.

- Reach out to independent insurance agents who can help you navigate different options and find the best quote for your needs.

Importance of Comparing Quotes from Multiple Providers

- Comparing quotes from multiple providers allows you to see the range of prices and coverage options available in the market.

- It helps you ensure you are not overpaying for your homeowners insurance and can potentially save you money in the long run.

- Different insurance companies may offer unique discounts or benefits that you can only discover through comparison.

Leveraging Online Tools and Resources

- Use online quote comparison tools that streamline the process of gathering quotes from different providers.

- Read reviews and customer feedback online to get a sense of the reputation and customer service of the insurance companies you are considering.

- Take advantage of online calculators that can help you estimate the coverage amount you need based on your specific circumstances.

Understanding Coverage Options

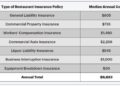

When it comes to homeowners insurance, understanding the different coverage options available is crucial in order to protect your home and belongings in the best way possible. Let's delve into the various types of coverage options and how they can impact your policy.

Basic Coverage vs. Additional Riders or Endorsements

- Basic Coverage: Typically includes coverage for the structure of your home, personal belongings, liability protection, and additional living expenses in case your home becomes uninhabitable due to a covered loss.

- Additional Riders or Endorsements: These are optional coverages that you can add to your policy for an extra cost to provide more comprehensive protection. Examples include coverage for expensive jewelry, art collections, or coverage for specific natural disasters not covered in the basic policy.

Factors Affecting Coverage Needs

- Location: The location of your home can greatly impact your coverage needs. For example, homes in areas prone to natural disasters like hurricanes or earthquakes may require additional coverage for such events.

- Type of Home: The type of home you own, whether it's a single-family house, condo, or vacation home, can also affect your coverage needs. Each type of home may have unique risks that should be addressed in your policy.

Factors Influencing Insurance Quotes

When it comes to getting the best homeowners insurance quote, there are several key factors that insurance companies consider before providing you with a rate. Understanding these factors can help you make informed decisions and potentially lower your premiums.

Home Value

The value of your home is a crucial factor in determining your insurance quote. Insurance companies will consider the cost to rebuild your home in case of damage or destruction, not the market value. Homes with higher values will typically have higher insurance premiums.

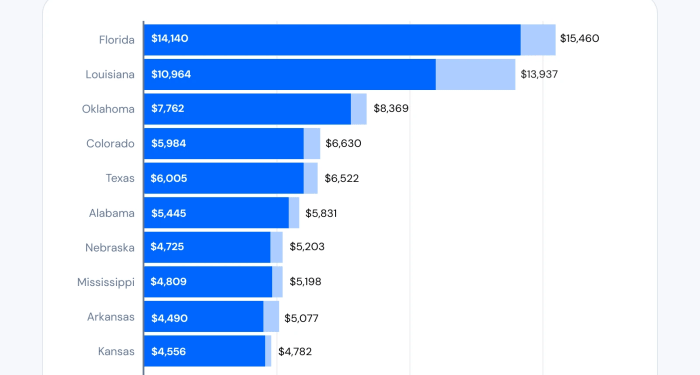

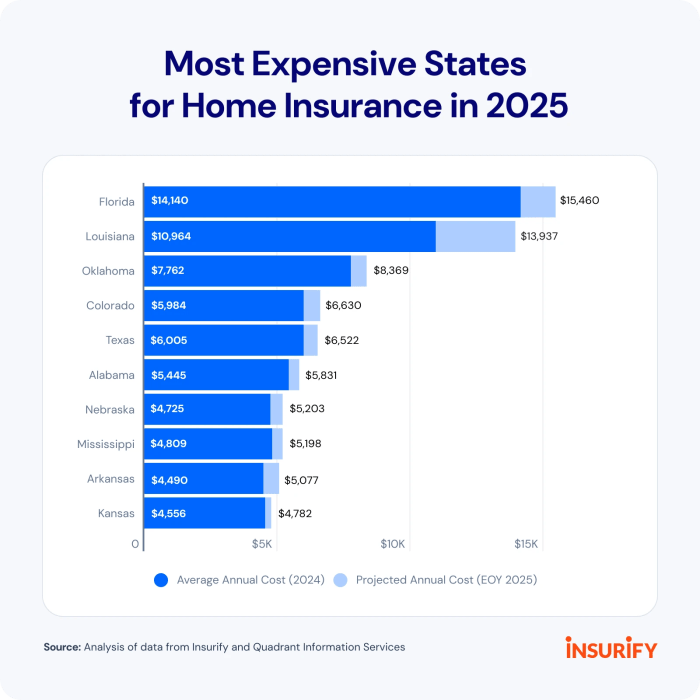

Location

The location of your home plays a significant role in your insurance rate. Homes in areas prone to natural disasters such as hurricanes, floods, or wildfires may have higher premiums due to the increased risk of damage. Additionally, living in a high-crime area can also impact your insurance costs.

Age of the Home

The age of your home can affect your insurance premium

Security Features

Homes with security features such as alarm systems, smoke detectors, and deadbolt locks are considered lower risks by insurance companies. Installing these features can help lower your insurance premiums by reducing the likelihood of theft or damage.

Credit Score and Claims History

Your credit score and claims history are also important factors in determining your insurance premiums. A higher credit score can signal to insurance companies that you are a responsible and less risky policyholder, potentially leading to lower rates. On the other hand, a history of frequent insurance claims may result in higher premiums as it suggests a higher risk of future claims.

Customizing Policies for Best Quotes

When looking to get the best homeowners insurance quote, customizing your policy can play a crucial role in securing a competitive rate. By making strategic adjustments to your coverage options, deductibles, and bundling choices, you can optimize your quote and potentially save money in the long run.

Bundling Options for Home and Auto Insurance

One effective way to lower your homeowners insurance premium is by bundling your home and auto insurance policies with the same provider. Insurance companies often offer discounts for customers who purchase multiple policies from them, so combining your coverage can result in significant savings.

- Research different insurance providers to compare bundle options and find the best deal.

- Consider the overall cost savings of bundling versus purchasing separate policies.

- Review the coverage details to ensure you are still receiving adequate protection for both your home and vehicles.

Adjusting Deductibles and Coverage Limits

Another way to customize your homeowners insurance policy for the best quote is by adjusting your deductibles and coverage limits. By tweaking these factors, you can find a balance between affordability and comprehensive coverage.

- Increase your deductible to lower your premium, but ensure you have enough savings set aside to cover the higher out-of-pocket costs in case of a claim.

- Review your coverage limits to make sure you are not over-insured or under-insured based on the value of your home and belongings.

- Consider adding endorsements or riders for specific items or risks that may not be covered under a standard policy.

Utilizing Technology for Quotes

Technology is revolutionizing the insurance industry, making it easier for homeowners to obtain the best insurance quotes. With the use of artificial intelligence (AI) and data analytics, insurance companies can more accurately assess risk factors and tailor quotes to individual needs.

Online Quote Comparison Tools

Online platforms now offer quote comparison tools that allow homeowners to easily compare different insurance policies and prices. These tools streamline the process of obtaining quotes from multiple insurers, helping homeowners find the best deals that suit their budget and coverage needs.

Role of Smart Home Devices

Smart home devices, such as security cameras, fire alarms, and leak detectors, are playing a significant role in potentially lowering insurance costs. These devices help mitigate risks by providing real-time monitoring and alerts, reducing the likelihood of accidents or break-ins.

Insurance companies may offer discounts to homeowners who invest in such smart home technology, as it demonstrates a proactive approach to risk management.

Closing Summary

In conclusion, mastering the art of securing the best homeowners insurance quote in 2025 requires a blend of knowledge, strategy, and technology. With the insights gained from this guide, you're well-equipped to make informed decisions and safeguard your home effectively.

FAQ Compilation

How can I save money on homeowners insurance in 2025?

To save money, consider bundling your home and auto insurance, raising your deductible, and maintaining a good credit score.

What factors impact homeowners insurance quotes the most?

The most significant factors are the location of your home, its value, security features, credit score, and claims history.

Are online quote comparison tools reliable for finding the best deals?

Yes, online quote comparison tools can be highly reliable in helping you find competitive rates and the best homeowners insurance deals.

Is it better to opt for basic coverage or add additional riders to the policy?

It depends on your individual needs. Basic coverage is more affordable, but additional riders provide extra protection tailored to your specific requirements.

How do smart home devices affect homeowners insurance costs?

Smart home devices can potentially lower insurance costs by improving security and reducing the risk of damages or break-ins.