Embark on a journey through the intricacies of Small Business Liability Insurance with our comprehensive guide. From understanding the basics to navigating key factors, this guide is your go-to resource for safeguarding your business.

Understanding Small Business Liability Insurance

Small business liability insurance is a type of insurance that provides financial protection to small businesses in the event of third-party claims for bodily injury, property damage, or other liabilities.

The Importance of Having Liability Insurance for Small Businesses

Having liability insurance is crucial for small businesses as it helps protect them from potential financial losses that may arise from lawsuits or claims filed against them. Without liability insurance, small businesses may face significant financial risks that could threaten their operations and viability.

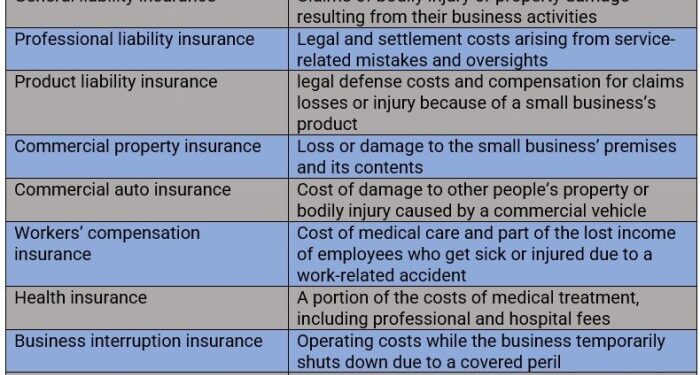

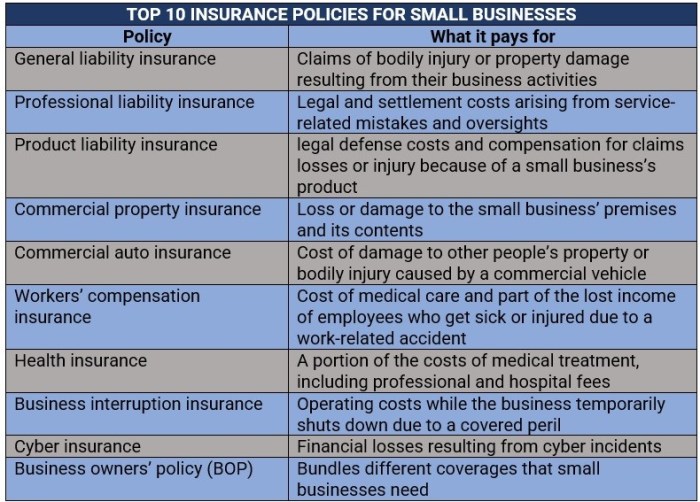

Types of Liability Insurance Coverage Available for Small Businesses

- General Liability Insurance: Covers claims related to bodily injury, property damage, advertising injury, and more.

- Professional Liability Insurance: Protects against claims of professional negligence, errors, or omissions.

- Product Liability Insurance: Provides coverage for claims related to product defects or injuries caused by products.

- Cyber Liability Insurance: Covers expenses related to data breaches, cyberattacks, and other cyber risks.

Risks Associated with Operating a Small Business Without Liability Insurance

Operating a small business without liability insurance can expose the business to various risks, including financial losses, legal expenses, damage to reputation, and even potential closure due to inability to cover liabilities arising from claims or lawsuits.

Factors to Consider When Buying Small Business Liability Insurance

Before purchasing liability insurance for your small business, there are several key factors to consider to ensure you get the right coverage at the best price. Understanding these factors will help you make an informed decision that protects your business and financial assets.

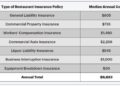

Cost Implications of Different Liability Insurance Options

When comparing different liability insurance options, it's essential to consider the cost implications. While general liability insurance provides basic coverage for common risks, specialized policies like professional liability insurance or product liability insurance offer more specific protection but may come at a higher cost.

Assess your business's unique needs and budget constraints to choose the most cost-effective option.

Impact of Business Size and Type on Insurance Coverage

The size and type of your small business can significantly impact the choice of liability insurance coverage. A larger business with more employees and higher revenue may require broader coverage to protect against increased risks. Additionally, the industry in which your business operates can influence the type of liability insurance needed.

For example, a construction company may require more robust coverage compared to a consulting firm.

Scenarios Where Liability Insurance Protects Small Businesses

Having liability insurance can protect small businesses in various scenarios, such as:

- Accidents on business premises resulting in bodily injury or property damage

- Lawsuits alleging negligence or professional errors

- Product-related claims from customers due to defects or injuries

- Advertising injuries like defamation or copyright infringement

By considering these factors and understanding how they apply to your small business, you can make an informed decision when purchasing liability insurance to safeguard your business against unforeseen risks.

Steps to Buying Small Business Liability Insurance

When it comes to purchasing small business liability insurance, it is essential for business owners to follow a step-by-step guide to ensure they get the right coverage for their specific needs. Below is a detailed process on how to assess a small business's liability insurance needs, evaluate insurance providers, and choose the right policy.

Assessing Small Business's Liability Insurance Needs

- Identify potential risks: Determine the specific risks your business faces that could lead to liability claims.

- Evaluate current coverage: Review any existing insurance policies to see what liabilities are already covered.

- Analyze business operations: Understand how your day-to-day activities could expose your business to liability risks.

- Consider industry requirements: Some industries have specific liability insurance requirements that you need to meet.

Evaluating Insurance Providers and Choosing the Right Policy

- Research insurance companies: Look into the reputation, financial stability, and customer reviews of potential insurance providers.

- Compare coverage options: Assess the different types of liability insurance policies available and choose one that aligns with your business needs.

- Review policy details: Carefully read through the policy terms, coverage limits, exclusions, and premiums to ensure you understand what you are getting.

- Seek professional advice: Consider consulting with an insurance broker or agent to help you navigate the complex world of small business liability insurance.

Tips for Managing Small Business Liability Insurance Effectively

Managing small business liability insurance effectively is crucial for protecting your business from financial risk. Here are some tips to help you navigate this process:

Regular Policy Reviews

- Regularly review your liability insurance policy to ensure it still aligns with your business needs and risks.

- Consider updating your coverage as your business grows or changes to avoid being underinsured.

- Consult with your insurance agent or broker to discuss any necessary adjustments to your policy.

Maintaining Accurate Records

- Keep detailed records of your liability insurance policies, including coverage amounts, renewal dates, and any changes made.

- Document any claims or incidents that may impact your liability coverage in the future.

- Organize your insurance paperwork in a secure and easily accessible location for quick reference.

Risk Management Strategies

- Implement risk management strategies to reduce the likelihood of insurance claims and potential liabilities.

- Train your employees on safety protocols and procedures to minimize workplace accidents.

- Regularly assess your business operations for any potential risks and address them proactively.

Last Recap

In conclusion, Small Business Liability Insurance is a vital shield for businesses of all sizes. By following the steps Artikeld in this guide, you can secure the protection your business deserves.

FAQs

What does small business liability insurance cover?

Small business liability insurance typically covers bodily injury, property damage, and legal fees in case of lawsuits.

How much does small business liability insurance cost?

The cost varies depending on factors like business size, industry, coverage limits, and location. It can range from a few hundred to several thousand dollars per year.

Is small business liability insurance mandatory?

While it's not legally required in most cases, having liability insurance is highly recommended to protect your business from unforeseen circumstances.