Investment tips for property development businesses sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Property development is a dynamic industry that requires strategic financial decisions. This guide delves into the crucial investment tips that can make or break a property development project, providing valuable insights for both seasoned developers and newcomers alike.

Importance of Investment Tips for Property Development Businesses

Investment tips play a crucial role in the success of property development businesses. By following these tips, businesses can make informed decisions, manage risks effectively, and maximize returns on their investments.

Impact of Following Investment Tips

- Proper financial planning: Investment tips help property development businesses create realistic budgets, allocate funds efficiently, and avoid overspending.

- Risk mitigation: By following investment tips, businesses can identify and mitigate potential risks such as market fluctuations, regulatory changes, or unexpected expenses.

- Optimizing returns: Investment tips enable businesses to identify lucrative opportunities, negotiate better deals, and maximize profits from property development projects.

Risks Associated with Property Development Businesses

- Market volatility: Property development projects are susceptible to market fluctuations, which can impact property values and project profitability.

- Regulatory challenges: Changes in zoning laws, building codes, or environmental regulations can pose risks to property development businesses.

- Financial uncertainties: Unforeseen expenses, delays in project completion, or lack of funding can jeopardize the success of property development ventures.

Researching Potential Properties for Development

When it comes to property development, thorough research is crucial in identifying the right opportunities for investment. By understanding the methods for researching potential properties and the key factors to consider, developers can make informed decisions that lead to successful projects.Experienced property developers often use a combination of methods to research and identify potential properties for development.

Some common strategies include:

Importance of Location, Market Trends, and Demographics

- Location: The location of a property plays a significant role in its potential for development. Factors such as proximity to amenities, accessibility, and neighborhood desirability can impact the success of a project.

- Market Trends: Keeping abreast of market trends is essential for understanding the demand for certain types of properties in a particular area. Developers should analyze market data to identify emerging opportunities.

- Demographics: Understanding the demographics of an area, including population growth, income levels, and age distribution, can help developers tailor their projects to meet the needs of the target market.

Conducting Due Diligence

- Due diligence involves a comprehensive assessment of a property to evaluate its potential risks and rewards. This process includes analyzing financial records, property condition, zoning regulations, and legal considerations.

- By conducting due diligence, property developers can mitigate risks and make well-informed investment decisions. It allows them to identify any potential obstacles or challenges that may impact the success of a development project.

Financial Planning and Budgeting for Property Development Projects

Effective financial planning and budgeting are crucial aspects of successful property development projects. By carefully managing finances, developers can ensure the profitability and sustainability of their ventures.

Creating a Financial Plan

A financial plan for a property development project involves analyzing the costs and revenues associated with the venture. The following steps can help developers create a comprehensive financial plan:

- Estimate the total project costs, including land acquisition, construction expenses, permits, and professional fees.

- Forecast potential revenues from the sale or rental of developed properties.

- Consider financing options, such as loans or equity investments, to fund the project.

- Develop a timeline for the project and allocate funds accordingly.

Setting Realistic Budgets

Setting realistic budgets is essential to avoid cost overruns and delays in property development projects. Strategies for setting realistic budgets include:

- Conducting thorough market research to understand current construction costs and property values.

- Consulting with experienced professionals, such as contractors and architects, to get accurate cost estimates.

- Including a buffer for unexpected expenses or price fluctuations in materials and labor.

- Regularly reviewing and adjusting the budget as the project progresses.

Importance of Contingency Funds

Contingency funds are crucial in property development projects to account for unforeseen events or changes in the market. It is essential to determine the appropriate amount of contingency funds based on the project's size, complexity, and risk factors

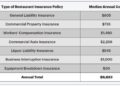

Securing Funding for Property Development Ventures

Securing funding is a crucial aspect of property development ventures, as it can determine the success or failure of a project. Identifying the right sources of funding and presenting a compelling investment proposal are key steps in this process.

Various Sources of Funding for Property Development Projects

- Bank Loans: Traditional bank loans are a common source of funding for property development projects. They offer competitive interest rates and structured repayment plans.

- Partnerships: Collaborating with other investors or developers can provide access to additional capital and expertise.

- Crowdfunding: This innovative funding option involves raising small amounts of money from a large number of individuals through online platforms.

Advantages and Disadvantages of Different Funding Options

- Bank Loans:

- Advantages:Competitive interest rates, structured repayment plans.

- Disadvantages:Stringent approval criteria, long processing times.

- Partnerships:

- Advantages:Access to additional capital and expertise.

- Disadvantages:Shared decision-making, potential conflicts of interest.

- Crowdfunding:

- Advantages:Diverse pool of investors, quick access to funds.

- Disadvantages:Limited amount of capital raised, regulatory constraints.

Presenting a Compelling Investment Proposal

- Highlight the potential return on investment (ROI) for investors.

- Showcase your track record and experience in property development.

- Provide a detailed project plan with clear timelines and milestones.

- Address potential risks and mitigation strategies in your proposal.

Risk Management Strategies for Property Development Investments

When it comes to property development investments, there are various risks that developers need to be aware of in order to protect their investments. By implementing effective risk management strategies, developers can mitigate these risks and increase the chances of a successful project.

Common Risks and How to Address Them

- Market Risk: Fluctuations in the real estate market can impact property values. To address this, developers can conduct thorough market research and feasibility studies before investing in a property.

- Construction Risk: Delays, cost overruns, and quality issues during construction can significantly impact the profitability of a project. Developers can mitigate this risk by working with experienced contractors, setting realistic timelines, and having contingency plans in place.

- Regulatory Risk: Changes in zoning laws, building codes, or environmental regulations can affect a development project. Developers should stay informed about regulatory changes and work closely with legal experts to ensure compliance.

Diversifying Investment Portfolios

One effective strategy for reducing risk exposure in property development investments is to diversify the investment portfolio. By spreading investments across different types of properties, locations, and development stages, developers can minimize the impact of market fluctuations or unforeseen events on their overall portfolio.

Risk Management Tools and Techniques

- Insurance: Property developers can protect their investments by obtaining insurance coverage for risks such as property damage, liability, and construction delays.

- Financial Hedging: Using financial instruments such as options or futures contracts can help developers manage financial risks associated with interest rate fluctuations or currency exchange rates.

- Risk Assessment: Conducting thorough risk assessments at each stage of the development process can help developers identify potential risks early on and implement appropriate risk management strategies.

Summary

In conclusion, mastering the art of investment tips for property development businesses is key to navigating the complex landscape of real estate ventures. By understanding the risks, conducting thorough research, and implementing sound financial strategies, developers can position themselves for success in this competitive field.

FAQs

What are some common risks associated with property development businesses?

Common risks include market fluctuations, regulatory changes, and unexpected construction delays.

How can property developers mitigate risks in their investment portfolios?

Developers can diversify their investments, conduct thorough due diligence, and maintain contingency funds to address unforeseen challenges.

What are some effective ways to secure funding for property development ventures?

Options include traditional loans, forming partnerships, or exploring crowdfunding platforms, each with its own advantages and disadvantages.