Exploring the realm of commercial building insurance for small businesses, this introduction delves into the crucial role it plays in protecting businesses from unforeseen risks. From potential financial losses to tailored coverage options, this overview sets the stage for a comprehensive discussion on safeguarding your property and finances.

As we navigate through the types of coverage, factors influencing costs, and selecting the right policy, small business owners will gain valuable insights into securing their assets effectively.

Importance of Commercial Building Insurance for Small Businesses

Commercial building insurance is essential for small businesses as it provides financial protection in case of unforeseen events or disasters. Without proper insurance coverage, small businesses are at risk of facing significant financial losses that could potentially lead to closure.

Potential Risks for Small Businesses without Insurance

Small businesses face various risks without commercial building insurance, such as:

- Damage from natural disasters like floods, fires, or earthquakes.

- Theft or vandalism of property.

- Liability claims from accidents on the premises.

Protection from Financial Losses

Commercial building insurance can safeguard small businesses from financial losses by covering the costs of repairing or replacing damaged property, equipment, and inventory. Additionally, it can help cover legal expenses in case of liability claims, ensuring that the business can continue to operate smoothly even after a setback.

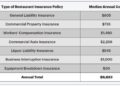

Types of Coverage Offered in Commercial Building Insurance

When it comes to commercial building insurance for small businesses, there are various types of coverage options available to protect your property and assets. Understanding the different types of coverage can help you choose the right policy that suits your business needs.

Basic Coverage

- Property Damage: This basic coverage typically includes protection for your building and its contents in case of damage due to fire, theft, vandalism, or natural disasters.

- Liability Insurance: This coverage protects your business from legal claims if someone is injured on your property or if your business causes damage to someone else's property.

Additional Coverage Options

- Business Interruption Insurance: This coverage helps cover lost income and expenses if your business is unable to operate due to a covered event.

- Flood Insurance: While not typically included in basic coverage, this additional option can protect your business from flood damage, which is not covered by standard policies.

Scenarios for Each Type of Coverage

- Property Damage: If your building is damaged in a fire, having property damage coverage can help cover the costs of repairs or rebuilding, ensuring your business can get back on track.

- Liability Insurance: If a customer slips and falls on your property, liability insurance can help cover legal fees and medical expenses, protecting your business from a potential lawsuit.

- Business Interruption Insurance: In the event of a natural disaster that forces your business to close temporarily, business interruption insurance can provide financial support to help you stay afloat until you can reopen.

- Flood Insurance: If your business is located in a flood-prone area, having flood insurance can protect your property and assets from water damage, allowing you to recover and rebuild without bearing the full financial burden.

Factors Affecting the Cost of Commercial Building Insurance

When it comes to commercial building insurance for small businesses, several key factors can influence the cost of premiums. Understanding these factors is crucial for businesses to manage their insurance costs effectively.

Location of the Building

The location of the building plays a significant role in determining insurance premiums. Buildings located in areas prone to natural disasters such as floods, earthquakes, or hurricanes may incur higher insurance costs due to the increased risk of damage.

Size of the Building

The size of the building, including the total square footage and number of floors, can impact insurance premiums. Larger buildings generally have higher replacement costs, which can result in higher premiums.

Age of the Building

The age of the building is another factor that insurance providers consider when determining premiums. Older buildings may have outdated wiring, plumbing, or structural components, which can increase the risk of damage and, in turn, lead to higher insurance costs.

Usage of the Building

The way in which the building is used also influences insurance premiums. Buildings used for high-risk activities such as manufacturing or chemical storage may face higher premiums due to the increased likelihood of accidents or property damage.

Ways to Reduce Insurance Costs

Small businesses can take several steps to potentially reduce insurance costs while maintaining adequate coverage. Implementing safety measures such as installing security systems, fire alarms, and sprinklers can help mitigate risks and lower premiums. Additionally, conducting regular maintenance and inspections to ensure the building is in good condition can demonstrate to insurers that the property is well-maintained and lower the likelihood of claims.

How to Choose the Right Commercial Building Insurance Policy

When it comes to selecting the right commercial building insurance policy for your small business, there are several important factors to consider. Evaluating your coverage needs, comparing quotes, and reviewing policy terms and conditions are essential steps in making an informed decision.

Additionally, tailoring the insurance policy to meet the specific requirements of your business can provide added protection and peace of mind.

Assess Your Coverage Needs

- Begin by assessing the specific risks and vulnerabilities faced by your small business. Consider factors such as the location of your commercial property, the nature of your business operations, and the value of your assets.

- Identify the types of coverage that are essential for protecting your business against potential risks, such as property damage, liability claims, and business interruption.

- Consult with an insurance professional to determine the appropriate level of coverage needed to safeguard your business assets and operations.

Compare Quotes and Policy Terms

- Obtain quotes from multiple insurance providers to compare coverage options and pricing. Consider factors such as deductibles, limits, and exclusions when reviewing quotes.

- Pay attention to the terms and conditions of each policy, including coverage limits, exclusions, and endorsements. Ensure that the policy aligns with your business needs and provides adequate protection.

- Seek clarification from insurance agents or brokers on any areas of the policy that are unclear or require further explanation.

Tailor the Policy to Meet Your Business Needs

- Consider customizing your insurance policy to address the specific risks and challenges faced by your small business. Add-ons such as business interruption coverage or equipment breakdown insurance can provide additional protection.

- Review the policy limits and adjust them based on the value of your commercial property and assets. Ensure that the coverage limits are sufficient to cover potential losses in the event of a claim.

- Regularly review and update your insurance policy to reflect changes in your business operations, property values, or industry regulations. Stay proactive in managing your insurance coverage to ensure comprehensive protection.

Ending Remarks

In conclusion, commercial building insurance is a vital shield for small businesses, offering protection against a myriad of potential threats. By understanding the nuances of coverage options and cost factors, businesses can make informed decisions to safeguard their future.

Question Bank

What are the common risks small businesses face without commercial building insurance?

Without insurance, small businesses are vulnerable to property damage, liability claims, and financial losses due to unforeseen events like natural disasters or theft.

How can small businesses reduce insurance costs while maintaining adequate coverage?

Small businesses can potentially lower insurance costs by implementing safety measures, choosing higher deductibles, bundling policies, and comparing quotes from multiple insurers.

What factors should small businesses consider when tailoring an insurance policy to their needs?

Small businesses should assess their property value, business operations, industry risks, and future growth plans to customize coverage that adequately protects their assets.