Delving into the realm of selecting optimal business health insurance for 2025, this introduction sets the stage for an enlightening exploration, promising a wealth of valuable insights in a manner that is engaging and informative.

Providing essential details and key points, the following paragraph paints a vivid picture of the topic at hand, ensuring a thorough understanding for readers.

Researching Business Health Insurance Options

When it comes to choosing the best business health insurance in 2025, conducting thorough research is crucial to make an informed decision. Researching different health insurance providers allows you to compare their offerings, rates, and customer reviews to find the most suitable option for your business.

Factors to Consider when Researching Business Health Insurance Options

- Provider Network: Check if your preferred doctors and hospitals are included in the provider network of the health insurance plan.

- Coverage Options: Evaluate the coverage options available, such as medical, dental, vision, and mental health services.

- Premium Costs: Compare the premium costs of different plans and consider your budget constraints.

- Deductibles and Copayments: Understand the deductibles and copayments associated with each plan to assess out-of-pocket expenses.

- Prescription Drug Coverage: Review the prescription drug coverage to ensure it meets the needs of your employees.

Significance of Understanding Coverage Details and Limitations

It is essential to delve into the coverage details and limitations of each business health insurance plan to avoid any surprises or gaps in coverage. Understanding what services are covered, any exclusions, and limitations can help you choose a plan that aligns with the healthcare needs of your employees and provides comprehensive coverage.

Evaluating Coverage Needs

When it comes to choosing the best business health insurance in 2025, evaluating coverage needs is a crucial step. Understanding the healthcare requirements of your employees is essential to providing them with adequate coverage and ensuring their well-being. In this section, we will discuss the process of assessing coverage needs, compare different types of coverage options, and explain how to determine the appropriate level of coverage based on employee demographics.

Assessing Healthcare Needs

- Start by analyzing the demographics of your workforce, including age, gender, and any pre-existing medical conditions.

- Consider the healthcare utilization patterns of your employees to identify common medical services or treatments they may require.

- Collect feedback from employees regarding their healthcare preferences and needs to tailor the coverage accordingly.

Comparing Coverage Options

- HMOs (Health Maintenance Organizations):Offer comprehensive coverage with lower out-of-pocket costs but require employees to choose a primary care physician.

- PPOs (Preferred Provider Organizations):Provide more flexibility in choosing healthcare providers at a higher cost, with lower out-of-network coverage.

- High-Deductible Plans:Come with lower premiums but higher deductibles, suitable for employees who are generally healthy and do not require frequent medical care.

Determining Coverage Levels

- Adjust the coverage level based on the age and health status of your employees, offering more comprehensive plans to older or sicker individuals.

- Consider the financial capabilities of your employees when selecting coverage options, ensuring they can afford the premiums and out-of-pocket expenses.

- Regularly review the coverage needs of your workforce and make adjustments as necessary to meet changing healthcare requirements.

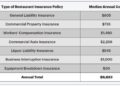

Cost Analysis and Budgeting

When choosing the best business health insurance in 2025, it is crucial to conduct a thorough cost analysis and establish a budget to ensure that you are getting the most value for your money.Setting a budget for health insurance premiums is essential to avoid financial strain on your business while still providing adequate coverage for your employees.

Balancing cost considerations with the level of coverage needed requires careful evaluation of the benefits and limitations of each plan.

Strategies for Analyzing Costs

- Compare premium costs: Evaluate the monthly or annual premium rates for different health insurance plans to determine which option aligns with your budget.

- Consider out-of-pocket expenses: Take into account deductibles, copayments, and coinsurance rates to understand the total cost of using the insurance.

- Review coverage details: Look at the services covered by each plan, including doctor visits, prescription drugs, and preventive care, to assess the overall value.

Importance of Setting a Budget

- Financial stability: Establishing a budget helps maintain financial stability for your business by avoiding unexpected healthcare costs.

- Employee retention: Providing affordable health insurance can improve employee satisfaction and retention rates, contributing to the overall success of your business.

- Long-term planning: A budget allows you to plan for future expenses and make informed decisions about health insurance coverage for years to come.

Balancing Cost and Coverage

- Assess business needs: Determine the healthcare needs of your employees and choose a plan that offers the right balance of cost and coverage based on those requirements.

- Explore cost-saving options: Consider high-deductible plans, health savings accounts (HSAs), or wellness programs to reduce costs without compromising on quality healthcare.

- Consult with insurance providers: Seek guidance from insurance professionals to understand the cost implications of different coverage options and make an informed decision.

Understanding Policy Terms and Conditions

When choosing the best business health insurance, it is crucial to have a clear understanding of the policy terms and conditions to ensure that you are getting the coverage your company needs. Paying attention to key terms and details can help you make informed decisions and avoid any surprises down the line.

Key Terms in Health Insurance Policies

- Deductibles: This is the amount you are required to pay out of pocket before your insurance coverage kicks in. Understanding your deductible can help you plan your budget accordingly.

- Copayments: These are fixed amounts that you pay for covered services at the time of service. Knowing your copayment amounts can help you estimate your out-of-pocket expenses.

- Coinsurance: This is the percentage of costs you share with your insurance company after you've met your deductible. It's important to know your coinsurance rate to understand how much you'll be responsible for paying.

Interpreting Policy Exclusions and Limitations

- Policy Exclusions: These are specific services or treatments that are not covered by your insurance policy. It's essential to review these exclusions to understand what your policy will not pay for.

- Policy Limitations: These are restrictions on coverage, such as annual or lifetime limits on certain benefits. Be sure to know the limitations of your policy to avoid any unexpected costs.

Network Coverage and Provider Options

When choosing a business health insurance plan, it is crucial to consider the network coverage provided. This determines which healthcare providers are included in the plan and can significantly impact access to medical services and costs.To evaluate the network of healthcare providers associated with each plan, start by researching the list of in-network doctors, specialists, hospitals, and other healthcare facilities.

Check if your preferred healthcare providers are included in the plan's network to ensure continuity of care and avoid unexpected out-of-pocket expenses.

Evaluating Network Coverage

- Review the list of in-network providers to see if your current doctors and specialists are included.

- Consider the proximity of in-network hospitals and healthcare facilities to your location for convenience.

- Check if the plan offers out-of-network coverage in case you need to see a provider who is not in the network.

- Research the reputation and quality of care provided by in-network healthcare providers to ensure high standards of treatment.

Compliance with Legal Requirements

In order to ensure that businesses are offering health insurance in compliance with legal requirements, it is essential to understand the various regulations and obligations that come into play. One of the key factors to consider is the Affordable Care Act (ACA) and its impact on business health insurance decisions.

By adhering to state and federal laws related to health insurance, businesses can avoid potential penalties and legal issues.

Affordable Care Act (ACA) Requirements

The Affordable Care Act (ACA) introduced several regulations that impact how businesses provide health insurance to their employees. Some key requirements include:

- Employer Mandate: Businesses with 50 or more full-time employees are required to offer affordable health insurance that meets certain minimum standards.

- Essential Health Benefits: Health insurance plans must cover essential health benefits, such as preventive care, prescription drugs, and maternity care.

- Minimum Value: Plans must provide minimum value coverage, meaning they cover at least 60% of total allowed costs.

- Individual Mandate: Individuals are required to have health insurance coverage, which can impact the overall pool of insured individuals.

Tips for Ensuring Compliance

To ensure compliance with state and federal laws related to health insurance, businesses can consider the following tips:

- Stay Informed: Regularly review updates and changes to health insurance regulations to ensure compliance.

- Work with Professionals: Consider consulting with legal and insurance experts to navigate complex legal requirements.

- Document Everything: Keep thorough records of health insurance policies, employee enrollment, and communication regarding health insurance benefits.

- Train Staff: Educate HR staff and employees on health insurance regulations to ensure everyone is aware of their rights and obligations.

- Review Policies Annually: Conduct annual reviews of health insurance policies to ensure they align with current legal requirements.

Last Word

Concluding our discussion on choosing the finest business health insurance in 2025, this final segment encapsulates the essence of our dialogue, leaving readers with a lasting impression and a deeper appreciation for the subject matter.

Essential FAQs

What factors should be considered when researching business health insurance options?

When researching, factors like coverage comprehensiveness, network coverage, and cost-effectiveness should be carefully evaluated.

How can businesses balance cost considerations with the level of coverage needed?

Businesses can achieve this balance by assessing employee healthcare needs, comparing plan costs, and opting for coverage that meets essential requirements without unnecessary expenses.

What legal requirements must businesses adhere to when offering health insurance?

Businesses must comply with regulations like the Affordable Care Act (ACA), ensuring employee access to affordable and comprehensive health insurance coverage.